10 Essential Steps to Launching Your Business in the UAE

-

Table of Contents

- 10 Essential Steps to Launching Your Business in the UAE

- 1. Conduct Market Research

- Key Considerations:

- 2. Choose the Right Business Structure

- Types of Business Structures:

- 3. Develop a Business Plan

- Components of a Business Plan:

- 4. Register Your Business

- Steps for Registration:

- 5. Secure Financing

- Funding Options:

- 6. Open a Business Bank Account

- Popular Banks in the UAE:

- 7. Obtain Necessary Permits and Licenses

- Common Licenses Required:

- 8. Set Up Your Office Space

- Popular Free Zones:

- 9. Hire Employees

- Key Hiring Considerations:

- 10. Launch Your Business

- Marketing Strategies:

- FAQs

- 1. What are the costs associated with starting a business in the UAE?

- 2. Can a foreigner own a business in the UAE?

- 3. How long does it take to register a business in the UAE?

- 4. What types of businesses are most successful in the UAE?

- 5. Are there any tax benefits for businesses in the UAE?

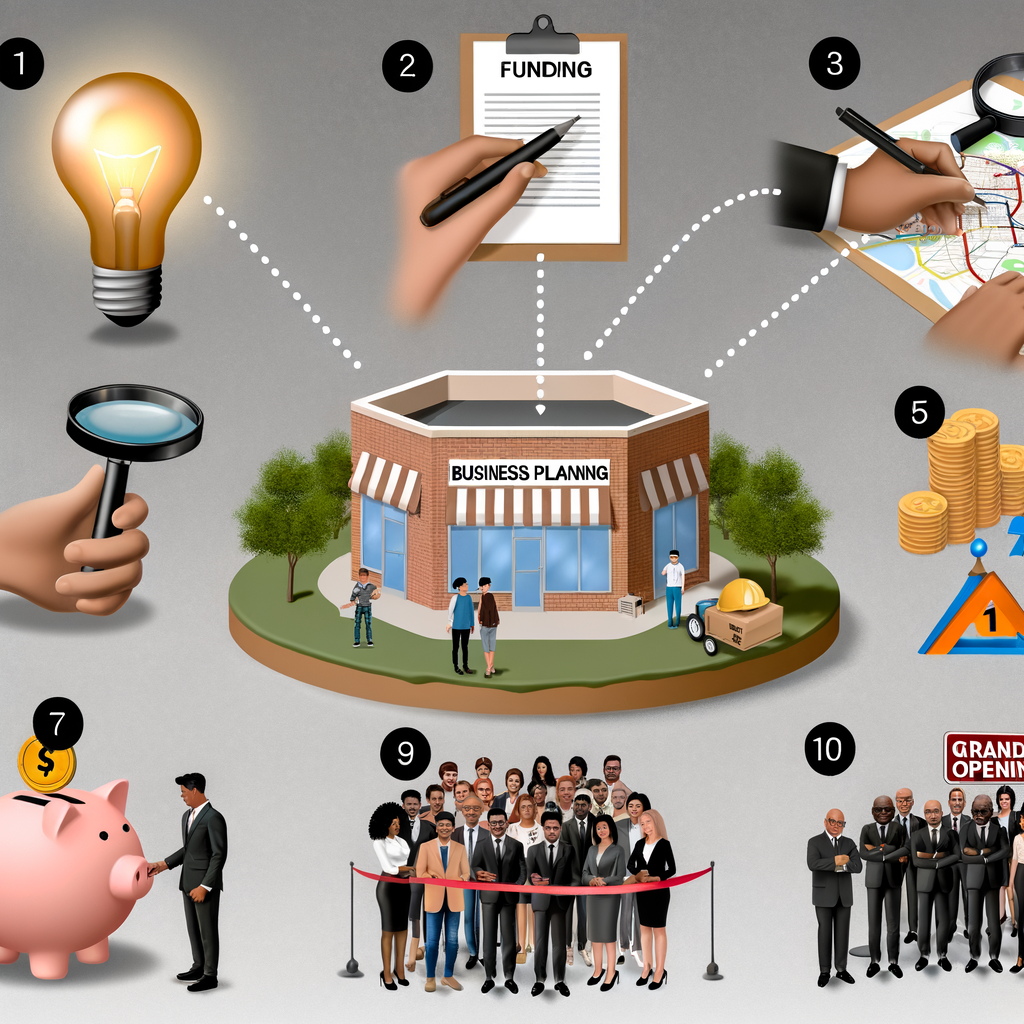

10 Essential Steps to Launching Your Business in the UAE

The United Arab Emirates (UAE) has emerged as a global business hub, attracting entrepreneurs and investors from around the world. With its strategic location, robust infrastructure, and business-friendly policies, the UAE offers a fertile ground for launching new ventures. However, navigating the complexities of starting a business in this dynamic environment requires careful planning and execution. This article outlines the ten essential steps to successfully launch your business in the UAE.

1. Conduct Market Research

Before diving into the business landscape, it is crucial to conduct thorough market research. Understanding the local market dynamics, consumer behavior, and competitive landscape will provide valuable insights. According to a report by Dubai Trade, 70% of startups fail due to a lack of market understanding.

Key Considerations:

- Identify your target audience and their preferences.

- Analyze competitors and their offerings.

- Evaluate market trends and growth potential.

2. Choose the Right Business Structure

The UAE offers various business structures, including sole proprietorships, partnerships, and limited liability companies (LLCs). Each structure has its own legal implications, ownership requirements, and tax obligations. For instance, a foreign investor may need a local sponsor to establish an LLC, while a sole proprietorship allows for 100% foreign ownership but limits liability.

Types of Business Structures:

| Business Structure | Ownership | Liability |

|---|---|---|

| Sole Proprietorship | 100% foreign ownership | Unlimited liability |

| Limited Liability Company (LLC) | 51% local sponsor required | Limited liability |

| Free Zone Company | 100% foreign ownership | Limited liability |

3. Develop a Business Plan

A comprehensive business plan is essential for outlining your business goals, strategies, and financial projections. It serves as a roadmap for your venture and is often required when applying for licenses or seeking funding. According to the Khan Academy, businesses with a formal plan are 16% more likely to achieve their goals.

Components of a Business Plan:

- Executive Summary

- Market Analysis

- Marketing Strategy

- Operational Plan

- Financial Projections

4. Register Your Business

Once your business plan is in place, the next step is to register your business with the relevant authorities. In the UAE, this typically involves obtaining a trade license from the Department of Economic Development (DED) or the relevant free zone authority. The registration process may vary depending on the business structure and location.

Steps for Registration:

- Choose a business name and ensure it complies with UAE naming conventions.

- Submit the required documents, including your business plan and identification.

- Pay the registration fees and obtain your trade license.

5. Secure Financing

Funding is a critical aspect of launching a business. Entrepreneurs in the UAE have access to various financing options, including bank loans, venture capital, and government grants. According to World Bank, the UAE ranks 16th globally in ease of obtaining credit.

Funding Options:

- Bank Loans

- Angel Investors

- Venture Capital Firms

- Government Grants and Initiatives

6. Open a Business Bank Account

After securing financing, it is essential to open a business bank account. This step is crucial for managing your finances, processing transactions, and maintaining transparency. Most banks in the UAE require a trade license, passport copies, and a business plan to open an account.

Popular Banks in the UAE:

7. Obtain Necessary Permits and Licenses

Depending on your business activities, you may need additional permits and licenses. For example, businesses in sectors such as healthcare, education, and food services require specific approvals from regulatory bodies. Failing to obtain the necessary licenses can result in fines or business closure.

Common Licenses Required:

- Commercial License

- Professional License

- Industrial License

8. Set Up Your Office Space

Choosing the right location for your business is vital for visibility and accessibility. The UAE offers various options, including free zones, co-working spaces, and traditional office setups. Free zones provide benefits such as tax exemptions and 100% foreign ownership, making them an attractive option for many entrepreneurs.

Popular Free Zones:

9. Hire Employees

Building a competent team is essential for the success of your business. The UAE has a diverse labor market, with a mix of local and expatriate talent. When hiring, ensure compliance with labor laws, including contracts, salaries, and benefits. According to Bayt.com, 60% of employers in the UAE face challenges in finding qualified candidates.

Key Hiring Considerations:

- Define job roles and responsibilities clearly.

- Offer competitive salaries and benefits.

- Ensure compliance with UAE labor laws.

10. Launch Your Business

After completing all the necessary steps, it’s time to launch your business. Develop a marketing strategy to create awareness and attract customers. Utilize digital marketing, social media, and traditional advertising to reach your target audience effectively. According to Statista, 90% of consumers conduct online research before making a purchase.

Marketing Strategies:

- Social Media Marketing

- Email Marketing

- Search Engine Optimization (SEO)

In conclusion, launching a business in the UAE involves a series of well-defined steps, from conducting market research to executing a successful launch. By following these essential steps, entrepreneurs can navigate the complexities of the UAE business landscape and position themselves for success.

FAQs

1. What are the costs associated with starting a business in the UAE?

The costs can vary significantly based on the business structure, location, and industry. On average, entrepreneurs can expect to spend between AED 10,000 to AED 50,000 for initial setup costs, including licensing, registration, and office space. Free zones may have different fee structures, often providing cost-effective solutions for startups.

2. Can a foreigner own a business in the UAE?

Yes, foreigners can own businesses in the UAE. In free zones, 100% foreign ownership is allowed. However, if you choose to set up an LLC outside of a free zone, you will need a local sponsor who holds at least 51% of the shares.

3. How long does it take to register a business in the UAE?

The registration process can take anywhere from a few days to several weeks, depending on the business structure and the completeness of your documentation. Free zone registrations are typically faster than those requiring local sponsorship.

4. What types of businesses are most successful in the UAE?

Industries such as tourism, hospitality, technology, and e-commerce have shown significant growth in the UAE. The government’s focus on innovation and diversification has also opened opportunities in renewable energy and healthcare sectors.

5. Are there any tax benefits for businesses in the UAE?

The UAE offers several tax benefits, including no corporate tax for most businesses and no personal income tax. However, certain sectors may be subject to specific taxes, such as the 5% Value Added Tax (VAT) on goods and services. Free zones often provide additional incentives, such as tax holidays and customs duty exemptions.