Online Banking Features of Emirates NBD Business Accounts

“Empower Your Business with Seamless Online Banking: Manage, Transact, and Grow with Emirates NBD.”

Introduction

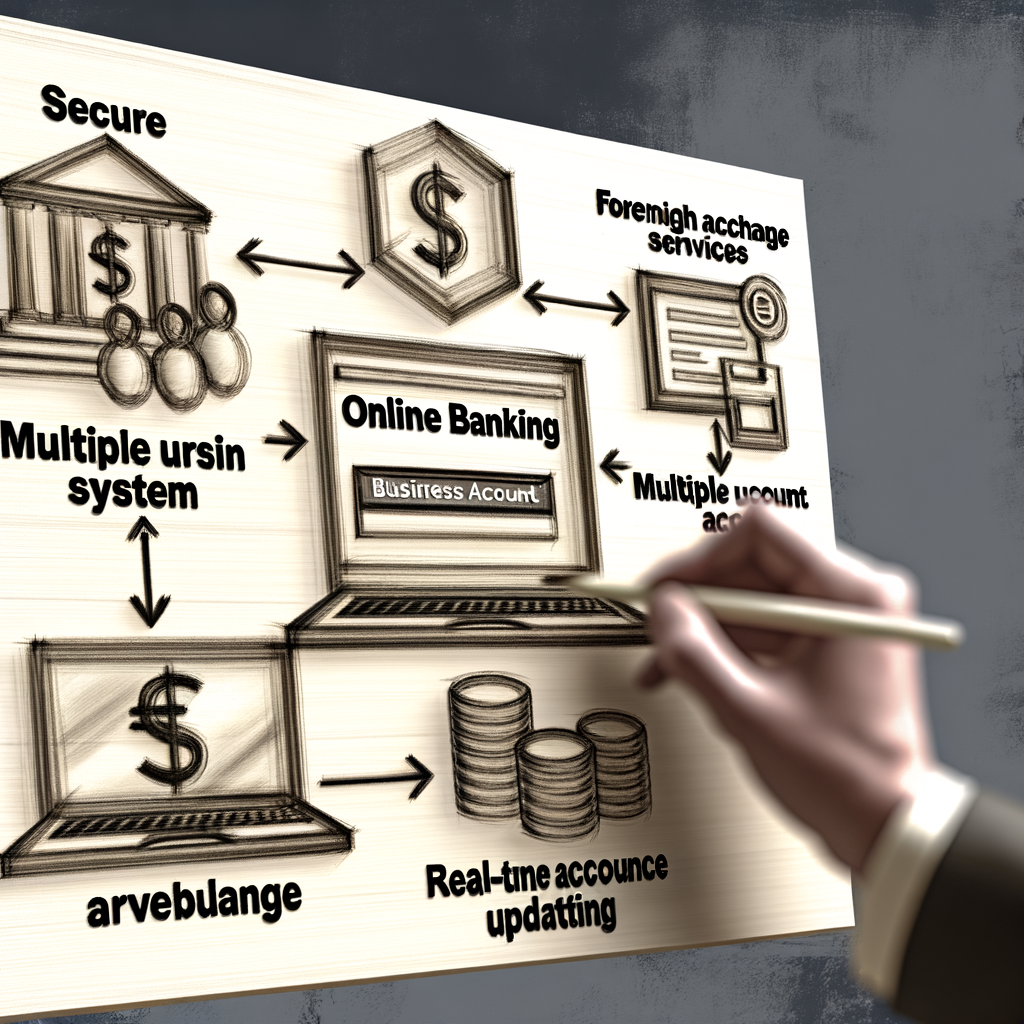

Emirates NBD offers a comprehensive suite of online banking features tailored for business accounts, designed to enhance financial management and streamline operations for enterprises of all sizes. With a user-friendly interface, businesses can easily access a range of services, including real-time account monitoring, fund transfers, payroll management, and detailed transaction reporting. The platform also supports multi-user access with customizable permissions, ensuring secure and efficient collaboration among team members. Additionally, Emirates NBD’s online banking includes advanced security measures, such as two-factor authentication and encryption, to protect sensitive financial information. Overall, these features empower businesses to manage their finances effectively and efficiently from anywhere, at any time.

Mobile Banking App Features for Emirates NBD Business Accounts

Emirates NBD offers a comprehensive mobile banking app tailored specifically for business accounts, providing a suite of features designed to enhance the banking experience for entrepreneurs and corporate clients. The app is engineered to facilitate seamless financial management, ensuring that businesses can operate efficiently and effectively in a fast-paced environment. One of the standout features of the Emirates NBD mobile banking app is its user-friendly interface, which allows users to navigate through various functionalities with ease. This intuitive design is crucial for busy professionals who require quick access to their financial information without the hassle of complicated menus.

Moreover, the app supports multiple user access, enabling businesses to assign different roles and permissions to employees. This feature is particularly beneficial for organizations that require collaborative financial management, as it allows designated team members to perform specific tasks such as approving transactions or accessing reports, all while maintaining security protocols. The app also incorporates advanced security measures, including biometric authentication and two-factor authentication, ensuring that sensitive financial data remains protected against unauthorized access.

In addition to security, the app provides real-time transaction monitoring, allowing businesses to track their financial activities as they occur. This feature is essential for maintaining oversight of cash flow and ensuring that all transactions are accounted for promptly. Users can view detailed transaction histories, categorize expenses, and generate reports, which aids in financial planning and analysis. Furthermore, the app enables users to initiate and manage fund transfers effortlessly, whether between accounts or to third parties, streamlining the payment process and reducing the time spent on administrative tasks.

Another significant aspect of the Emirates NBD mobile banking app is its integration with various financial tools and services. For instance, businesses can access features such as invoice management and payment reminders, which help streamline accounts receivable processes. This integration not only enhances operational efficiency but also improves cash flow management, allowing businesses to focus on growth rather than administrative burdens. Additionally, the app provides access to foreign exchange services, enabling businesses to conduct international transactions with ease and at competitive rates.

The app also includes a comprehensive dashboard that offers insights into account balances, transaction summaries, and spending patterns. This feature empowers business owners to make informed financial decisions based on real-time data. By analyzing spending habits and identifying trends, businesses can optimize their budgets and allocate resources more effectively. Furthermore, the app supports various currencies, making it an ideal solution for businesses engaged in international trade.

As businesses increasingly rely on digital solutions, the Emirates NBD mobile banking app stands out as a vital tool for managing finances on the go. The convenience of mobile banking allows business owners to conduct transactions, monitor accounts, and access financial information anytime and anywhere, thereby enhancing productivity. In conclusion, the mobile banking app for Emirates NBD business accounts is a robust platform that combines security, efficiency, and user-friendly design. By leveraging these features, businesses can streamline their financial operations, improve cash flow management, and ultimately drive growth in an increasingly competitive landscape. The app not only meets the current needs of businesses but also positions them for future success in a digital-first world.

Enhanced Security Measures in Emirates NBD Online Banking

In the realm of online banking, security is paramount, especially for business accounts that handle sensitive financial information. Emirates NBD recognizes this critical need and has implemented a suite of enhanced security measures designed to protect its clients’ assets and data. These measures not only safeguard transactions but also instill confidence in users as they navigate the digital banking landscape.

To begin with, Emirates NBD employs advanced encryption technologies that ensure all data transmitted between the user and the bank remains confidential. This encryption acts as a robust barrier against potential cyber threats, making it exceedingly difficult for unauthorized parties to intercept or decipher sensitive information. Furthermore, the bank utilizes secure socket layer (SSL) protocols, which are industry standards for establishing an encrypted link between a web server and a browser. This means that any information exchanged during online banking sessions is shielded from prying eyes, thereby enhancing the overall security of business transactions.

In addition to encryption, Emirates NBD has integrated multi-factor authentication (MFA) into its online banking platform. This feature requires users to provide two or more verification factors before gaining access to their accounts. Typically, this involves something the user knows, such as a password, combined with something the user possesses, like a mobile device that receives a one-time password (OTP). By implementing MFA, Emirates NBD significantly reduces the risk of unauthorized access, as even if a password is compromised, the additional verification step acts as a formidable line of defense.

Moreover, the bank has established real-time transaction monitoring systems that continuously analyze account activity for any unusual patterns or behaviors. This proactive approach allows Emirates NBD to detect and respond to potential fraud attempts swiftly. If a transaction appears suspicious, the system can trigger alerts, prompting further verification from the account holder before proceeding. This not only protects the business’s financial resources but also enhances the overall user experience by minimizing the risk of fraudulent activities.

Another noteworthy feature is the bank’s commitment to regular security updates and patches. In an ever-evolving digital landscape, cyber threats are constantly changing, and staying ahead of these threats is crucial. Emirates NBD ensures that its online banking platform is regularly updated to address any vulnerabilities that may arise. This commitment to maintaining a secure environment reflects the bank’s dedication to safeguarding its clients’ interests.

Furthermore, Emirates NBD provides comprehensive user education on best practices for online security. By equipping clients with knowledge about potential threats and safe banking habits, the bank empowers them to take an active role in protecting their accounts. This educational initiative includes guidance on recognizing phishing attempts, creating strong passwords, and understanding the importance of secure internet connections.

In conclusion, the enhanced security measures implemented by Emirates NBD for its online banking services are a testament to the bank’s commitment to protecting its business clients. Through advanced encryption, multi-factor authentication, real-time monitoring, regular updates, and user education, Emirates NBD creates a secure online banking environment that not only mitigates risks but also fosters trust. As businesses increasingly rely on digital banking solutions, these robust security features ensure that they can conduct their financial activities with peace of mind, knowing that their assets and information are well-protected.

Streamlined Payment Solutions for Emirates NBD Business Customers

Emirates NBD offers a comprehensive suite of online banking features tailored specifically for business customers, ensuring that financial management is both efficient and effective. One of the standout aspects of their service is the streamlined payment solutions designed to facilitate seamless transactions. These solutions are particularly beneficial for businesses that require quick and reliable payment processing, allowing them to focus on their core operations without the burden of cumbersome financial procedures.

To begin with, Emirates NBD provides a robust online platform that enables businesses to manage their payments with ease. The user-friendly interface allows customers to initiate and track payments in real-time, ensuring transparency and control over financial activities. This is particularly advantageous for businesses that operate in fast-paced environments where timely payments are crucial. By leveraging advanced technology, Emirates NBD ensures that transactions are processed swiftly, minimizing delays that could impact business operations.

Moreover, the bank’s online banking system supports a variety of payment methods, catering to the diverse needs of its business clientele. From local transfers to international remittances, Emirates NBD offers a range of options that facilitate both domestic and cross-border transactions. This flexibility is essential for businesses that engage in global trade or have suppliers and clients in different countries. The ability to execute multiple payment types from a single platform simplifies the financial management process, allowing businesses to allocate resources more effectively.

In addition to diverse payment options, Emirates NBD also prioritizes security in its online banking features. The bank employs state-of-the-art encryption technologies and multi-factor authentication processes to safeguard sensitive financial information. This commitment to security not only protects businesses from potential fraud but also instills confidence in their financial transactions. As businesses increasingly rely on digital platforms for their operations, the assurance of secure transactions becomes paramount.

Furthermore, the integration of automated payment solutions enhances the efficiency of financial operations for Emirates NBD business customers. Automated payment scheduling allows businesses to set up recurring payments, ensuring that obligations such as supplier invoices and payroll are met on time without manual intervention. This feature not only reduces the risk of late payments but also frees up valuable time for business owners and financial teams, enabling them to concentrate on strategic initiatives rather than routine tasks.

Another significant advantage of Emirates NBD’s online banking features is the comprehensive reporting and analytics tools available to business customers. These tools provide insights into cash flow, payment trends, and overall financial health, empowering businesses to make informed decisions. By analyzing payment data, businesses can identify areas for improvement, optimize their cash management strategies, and ultimately enhance their financial performance.

In conclusion, the streamlined payment solutions offered by Emirates NBD for business accounts represent a significant advancement in the realm of online banking. With a focus on efficiency, security, and flexibility, these features are designed to meet the evolving needs of modern businesses. By providing a comprehensive platform that simplifies payment processing and enhances financial oversight, Emirates NBD positions itself as a valuable partner for businesses seeking to thrive in a competitive landscape. As companies continue to navigate the complexities of financial management, the innovative solutions provided by Emirates NBD will undoubtedly play a crucial role in their success.

Q&A

1. **What online banking features are available for Emirates NBD Business Accounts?**

Emirates NBD Business Accounts offer features such as fund transfers, bill payments, account management, and access to financial statements through the online banking platform.

2. **Can I manage multiple accounts through Emirates NBD’s online banking?**

Yes, Emirates NBD allows users to manage multiple business accounts under one online banking profile for easier access and management.

3. **Is there a mobile app for managing Emirates NBD Business Accounts?**

Yes, Emirates NBD provides a mobile banking app that allows business account holders to perform transactions, check balances, and manage their accounts on the go.

Conclusion

Emirates NBD Business Accounts offer a comprehensive suite of online banking features that enhance convenience and efficiency for businesses. Key features include real-time account management, seamless fund transfers, customizable payment solutions, and robust security measures. Additionally, the platform provides access to detailed financial reporting and analytics, enabling businesses to make informed decisions. Overall, the online banking capabilities of Emirates NBD Business Accounts empower businesses to streamline their financial operations and improve overall productivity.